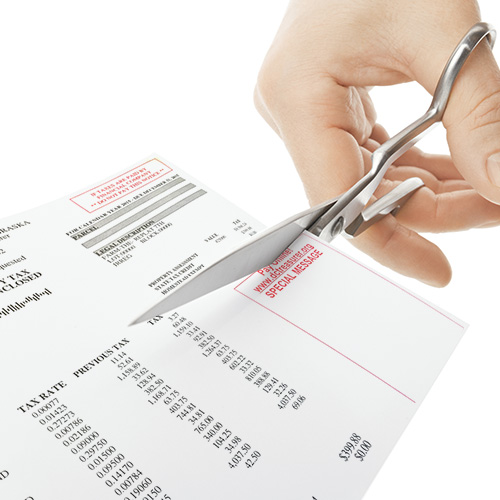

Taxes

Taxes in Nebraska are too high – especially property taxes and income taxes.

Property Tax Relief:

Ended Automatic Tax Hikes When Property Valuations Increase

In 2019, Legislative Bill 103 introduced by Senator Linehan, was passed by the Legislature and signed into law by the Governor increasing transparency and accountability for setting local property tax rates. It protects Nebraskans from an automatic tax increase by cities, counties, school districts and other local political subdivisions when property values increase.

Local taxing authorities will now be required to hold a hearing and vote to collect more in property taxes by taking advantage of increased valuations. The new process will give an opportunity for taxpayers to be heard, allow for debate on the question of collecting more property tax revenue, and will require local officials to vote on the issue.

Ensured the Property Tax Credit Relief Fund Increased to $550 Million Over Two Years

In 2019, Senator Linehan introduced an amendment to the state budget bills increasing two-year funding for the Property Tax Credit Relief Fund from the $525 million recommended by the Appropriations Committee to $550 million. The Linehan amendment to increase property tax relief by an additional $25 million was adopted by a vote of 28-8.

The $550 million over two years for the Property Tax Credit Relief Fund represents a 23% increase from the $448 million included in the previous two-year budget.

Valuation Reductions for Property Damaged or Destroyed by Natural Disasters

LB 512, introduced by Senator Linehan, was amended to include a provision allowing Nebraskans who have damaged or destroyed property as a result of a natural disaster to apply for a reduced property valuation if the event occurred in the first half of the calendar year. The concept was added to LB 512 after being introduced by Senator Steve Erdman as LB 482. Eligible properties must have been impacted by a natural disaster in the first six months of a calendar year and property owners will have until July 15 of the year in which the natural disaster struck to apply for a reduced valuation.

For Nebraskans whose lives have been turned upside down by a natural disaster, especially those impacted by this year’s historic floods, LB 512 provides much needed property tax relief. This is important relief for property owners in hard-hit areas of Western Douglas County including Valley and Waterloo, as well as thousands of property owners in other Nebraska counties.

Income Tax Relief:

Reducing State Income Taxes on Social Security and Retirement Income

In 2018 Senator Linehan voted to reduce the tax burden on Social Security income by indexing the tax rate to inflation. The bill passed and the Governor signed it into law. So now as a retiree’s Social Security benefit increases, the state tax rate will decrease, and the state won’t reap a windfall in tax revenue.

Senator Linehan has voted for legislation reducing state income taxes on military retirement income.

Lou Ann supports eliminating the state income tax on Social Security income and on military retirement income.

She also supports reducing Nebraska’s top individual income tax rate and the corporate tax rate. Both are among the region’s highest.